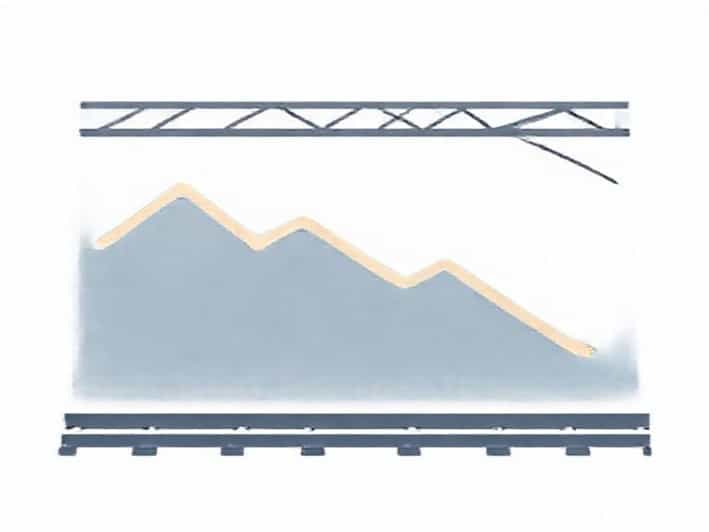

Railway stocks are under pressure after a strong run in 2024, with several key names sliding significantly from their highs. The pullback reflects a mix of disappointing earnings, slower capital spending, and broader macroeconomic concerns. For investors tracking railway industry momentum, the recent decline raises questions about whether the correction is a warning sign or a chance to pick up value.

Recent Decline in Railway Stocks

In early 2025, many railway stocks have erased a substantial portion of their gains from the 2024 peak. According to Moneycontrol, companies like Indian Railway Finance Corporation (IRFC), Rail Vikas Nigam (RVNL), RailTel, Ircon, Titagarh Rail, and others have dropped **up to 48%** from their 52-week highs. contentReference[oaicite0] Similarly, The Financial Express reports that IRCTC and RVNL have seen **freefall declines of around 30%** since their highs earlier in the year. contentReference[oaicite1] In addition, shareholders cite weak execution, muted order inflows, and lack of capex support as major drags on the railway sector’s momentum. contentReference[oaicite2]

Why Are Railway Stocks Falling?

Budget Disappointments and Capex Concerns

One of the biggest catalysts for the pullback was the 2025 Union Budget, which left railway capital expenditure nearly unchanged. contentReference[oaicite3] Investors had hoped for a sharp increase in rail sector capex, but the budget allocation disappointed many, triggering a wave of profit booking in railway PSUs.

Earnings Underperformed

Several railway companies reported results that fell short of market expectations. As noted by analysts, the street was expecting a bumper set of results…. and that has not been the case. contentReference[oaicite4] This sentiment fed into selling pressure, especially for those names that had rallied aggressively heading into 2024.

Economic and Freight Volume Risks

On the U.S. side, the rail industry is also facing headwinds. According to the Association of American Railroads (AAR), while carloads excluding coal rose modestly in 2024, total carloads declined. contentReference[oaicite5] Coal, a historically important freight category, is shrinking, which reduces a major part of rail volume. contentReference[oaicite6] AAR’s latest reports highlight manufacturing weakness and uncertainty around trade policy as major risks for future volume growth. contentReference[oaicite7] Investors may be concerned that if these trends worsen, rail traffic could slow, limiting long-term earnings growth.

Regulatory and Structural Risks

Beyond volume and earnings, there are other structural risks. For instance, consolidation risk has entered the picture major U.S. railroads like Union Pacific and Norfolk Southern are reportedly in merger talks, raising regulatory, labor, and safety concerns. contentReference[oaicite8] Such a deal could reshape competition, but unions and worker groups warn of higher derailment risks and labor fallout. contentReference[oaicite9] The uncertainty around policy shifts and trade could weigh on railroads’ ability to lock in profitable long-term contracts.

Key Railway Stocks (India) That Have Slipped

Some of the major Indian railway-related stocks that have seen sharp corrections include

- IRFCDown nearly **44%** from its July 2024 high of â¹229.05. contentReference[oaicite10]

- RVNLShares dropped ~45% from its 52-week peak of â¹647. contentReference[oaicite11]

- IRCTCFell about **35%** from its high of â¹1,139, reaching a 52-week low of â¹743.75. contentReference[oaicite12]

- RailTel, Ircon, Titagarh Rail Systems, Texmaco RailEach of these stocks has corrected by ~4048%, signalling broad weakness across the railway infrastructure sector. contentReference[oaicite13]

Investor Reactions and Sentiment

Investors appear cautious and profit-taking is widespread. According to Livemint, railway PSU stocks fell up to **6% in a single day** following budget-related disappointment. contentReference[oaicite14] Analysts like Siddhartha Khemka of Motilal Oswal suggest that while the current fall might create opportunities, the market’s optimism must align with actual government action and order execution. contentReference[oaicite15]

Are There Opportunistic Viewpoints?

Despite the sell-off, some analysts still see long-term value. The Financial Express notes that certain railway stocks are now trading at attractive levels after the correction. contentReference[oaicite16] Khemka also warns that while downside risk exists, the weakness might be cyclical, meaning some consolidation could set the stage for future gains if capex resumes. contentReference[oaicite17] Moreover, AAR’s May 2025 industry report suggests underlying economic strength such as steady consumer spending and core demand remains resilient. contentReference[oaicite18] If rail freight continues to reflect economic recovery, it could bolster future volume growth.

Risks That Could Push Railway Stocks Lower

Investors should be aware of several key risks if they are considering re-entry or accumulation

- Capex RiskIf expected government investment does not materialize, infrastructure players will struggle to grow.

- Volume RiskContinued weakness in industrial freight categories like coal, metals, or weak manufacturing could hurt traffic and margins.

- M&A RiskMerger consolidation (such as Union Pacific-Norfolk Southern in the U.S.) could bring regulatory hurdles, labor issues, and integration costs. contentReference[oaicite19]

- Safety & Regulatory RiskLarge-scale mergers may face union resistance and safety scrutiny. contentReference[oaicite20]

- Earnings PressureIf rail companies miss earnings again, more sell-offs could follow.contentReference[oaicite21]

What Lies Ahead Possible Scenarios

Given the current dynamics, there are a few potential scenarios for how railway stocks could play out in the coming months

- Consolidation PhasePrices may stabilize at current levels as investors digest earnings and await government capex announcements. This could be a base-building period.

- Recovery on Capex RevivalIf the government steps up infrastructure spending or clears major railway project orders, the next leg of growth could begin.

- Further CorrectionIn case of broader economic weakness or weaker freight demand, railway stocks may correct more deeply, testing lower support.

- M&A & Structural ShiftA significant merger or reorganization (especially in markets like the U.S.) could reshape the competitive structure and cost base but also bring execution risk.

The sharp decline in railway stocks from their 2024 highs reflects a complex mix of disappointment on capital spending, earnings shortfalls, and macro uncertainty. Major Indian PSU rail names like IRFC, RVNL, IRCTC, and RailTel have retraced up to **48%**, punishing investors who bet on continued momentum. contentReference[oaicite22] At the same time, industry data from the U.S. rail sector shows mixed signals while some volume categories are firm, coal’s slump and a weak manufacturing outlook raise real concerns. contentReference[oaicite23] For long-term investors, this decline may offer a chance to accumulate, but only if future capex, regulatory clarity, and volume recovery align with expectations. The key will be monitoring order flow, policy actions, and earnings execution. Until then, caution and a close eye on industry signals will remain essential.